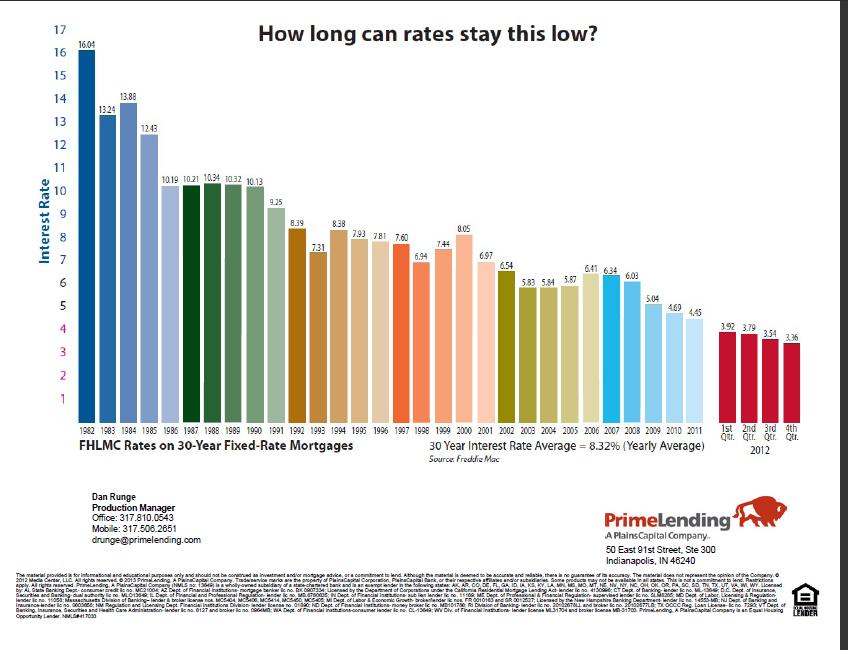

If you have been around for a while and purchased a home in the early 80’s you know that interest rates today are at historic lows. I know this well because my husband and I purchased our first home in 1983 at 13%. Seeing the graphic below from Dan Runge of Prime Lending graphically displays the fall of mortgage interest rates over the last 3 years.

For example if you had purchased a home in 1983 for $200,ooo with 3.5% down your principal and interest payment would have been approximately $2,171.23 at today’s rate your principal and interest payment would be approximately $851.64. If you could afford a P&I payment of $2,171.23 today, you could buy a home in the range of $492,000.

If this does not get you off the fence, what will? Call me for an appointment today our inventory levels are very low (down approximately 12.6% from 12/11 – 12/12 in Fishers, see graphic below) and homes are selling!

**Calculations above are estimates only and are for illustration, call the lender of your choice for more accurate figures**