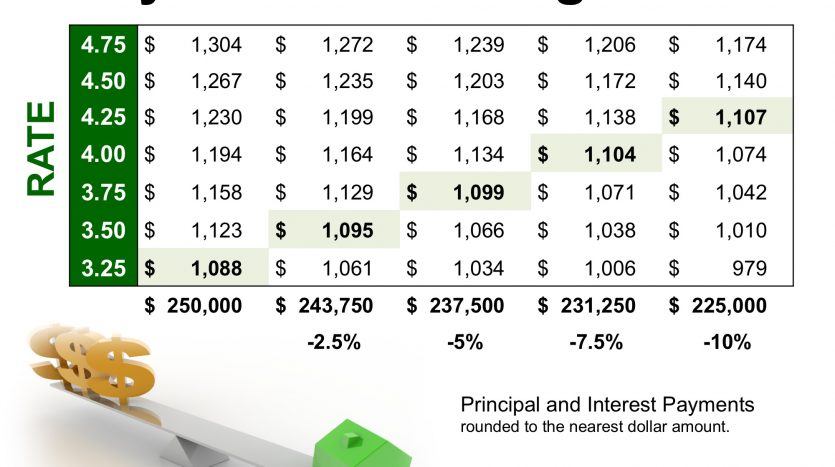

Lately on the news rising and falling interest rates have been a significant point of discussion. If you’re like most people, you wonder how that effects you as a consumer. Specifically in the world of real estate, interest rates can have a huge effect on your purchasing power. Interest rates are currently at a historic low and are expected to rise after the election. Those who are debating whether to buy now or wait should consider this as part of their decision. The chart below illustrates your estimated monthly payment for homes in the $250,000 – $225,000 price range at different interest rates and the results are quite striking.

Source: Keeping Current Matters

Currently, interest rates nationwide average 3.47%. For a $250,000 home, your current payment would be around $1100. If interest rates rise just .5% percent, the home you can afford for that monthly payment is automatically reduced over $18,000 to approximately $231,000. What does this mean for you? With interest rates expected by many to rise shortly after the election, buying now might be a better decision than waiting until the spring. Call us today to discuss how to begin the process!